Driver safety apps have become standard tools for millions of drivers worldwide. They monitor your behavior, alert you to hazards, and can even detect crashes automatically.

At DriverEducators.com, we’ve seen firsthand how these apps transform driving habits and reduce accident rates. This guide covers the features that matter, how they lower your risk, and which app fits your needs.

What Makes Driver Safety Apps Actually Work

Real-Time Alerts Stop Dangerous Behavior Before Crashes Happen

Real-time alerts catch dangerous moments before they escalate into collisions. When you accelerate too hard, brake suddenly, or exceed the speed limit, these apps notify you instantly so you can adjust your behavior on the spot. A 2023 national observational survey found that 2.1% of drivers stopped at intersections were talking on hand-held phones at any moment during the day. Apps like DriveMode and DriveSmart solve this problem by locking distracting features and routing calls to voicemail automatically. DriveMode uses voice commands to handle navigation, texts, and calls without touching your screen, while DriveSmart mutes notifications entirely and can auto-reply that you’re driving.

Incentives and Feedback Transform Driving Habits

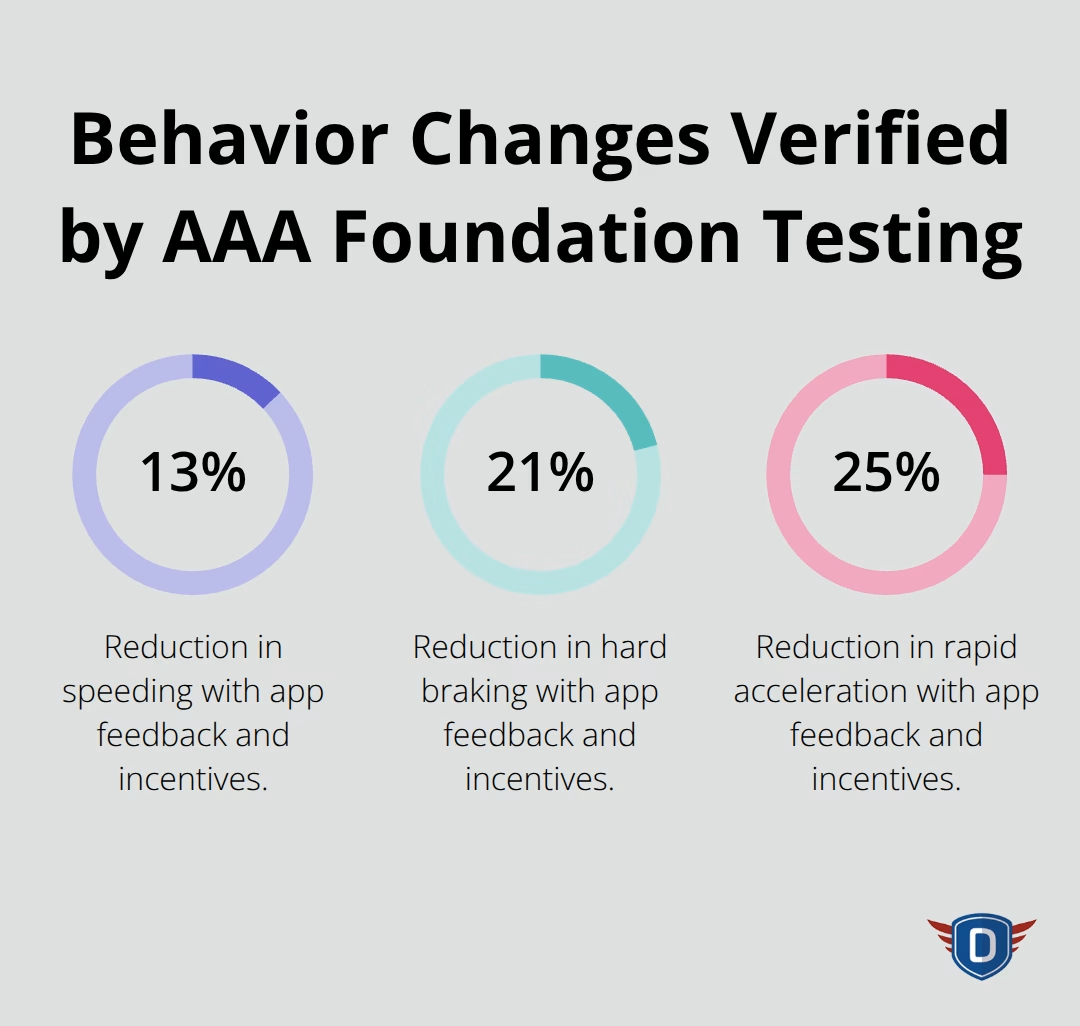

The AAA Foundation tested feedback and monetary incentives from safe-driving apps and found they reduced speeding by up to 13%, hard braking by 21%, and rapid acceleration by 25%. These aren’t marginal improvements-they represent the difference between a near-miss and a collision. OnMyWay takes a different approach by paying users per mile when their phone stays locked, turning safe driving into cash rewards and claiming it has prevented 28,000 crashes.

TrueMotion Family tracks speeding, unsafe stops, and illegal maneuvers across multiple drivers, then provides concrete improvement tips rather than vague safety advice. The app’s feedback helps you identify actionable changes specific to your driving patterns.

Crash Detection and Emergency Response Activate Automatically

Crash detection and emergency response features activate when impact sensors detect a collision. Your phone immediately alerts emergency services with your exact location, and some apps notify family members simultaneously. LifeSaver fully locks all phone features during driving and allows parents to prevent the lock from being disabled, which proves especially valuable for teen drivers who face the highest crash risk. Using a cell phone while driving creates enormous potential for deaths and injuries on U.S. roads, with 3,275 people killed in motor vehicle crashes in 2023 involving distracted driving.

Multiple Defenses Work Together for Maximum Protection

The most effective apps combine multiple defenses to protect you on the road. They detect phone use through accelerometers and gyroscopes, they provide location and timing data to identify exactly when and where risky behavior happens, and they give you feedback specific to your driving patterns rather than generic warnings. This layered approach addresses the root causes of accidents rather than treating symptoms. Understanding which features matter most for your situation helps you select an app that actually fits your driving needs and lifestyle.

How Driver Safety Apps Cut Insurance Costs and Change Behavior

Insurers Reward Monitored Drivers with Measurable Savings

Safe driving apps deliver measurable savings on auto insurance premiums because insurers recognize that monitored drivers pose lower risk. Most carriers start with around a 10% discount upon enrollment, and safe drivers can earn reductions up to 25% or more depending on the insurer and your driving record. Progressive Snapshot, State Farm Drive Safe & Save, Geico DriveEasy, and Liberty Mutual RightTrack all tie discounts directly to telematics data showing reduced speeding, smoother acceleration, and fewer hard braking events. The discount structure matters more than you might think: some insurers calculate savings based on sustained safe behavior over months, while others reward immediate improvements. Contact your insurer to understand exactly how their program calculates discounts and whether you need to maintain certain driving standards to keep the savings active. Ongoing safe driving is often required, meaning lapses in behavior can reduce or eliminate benefits.

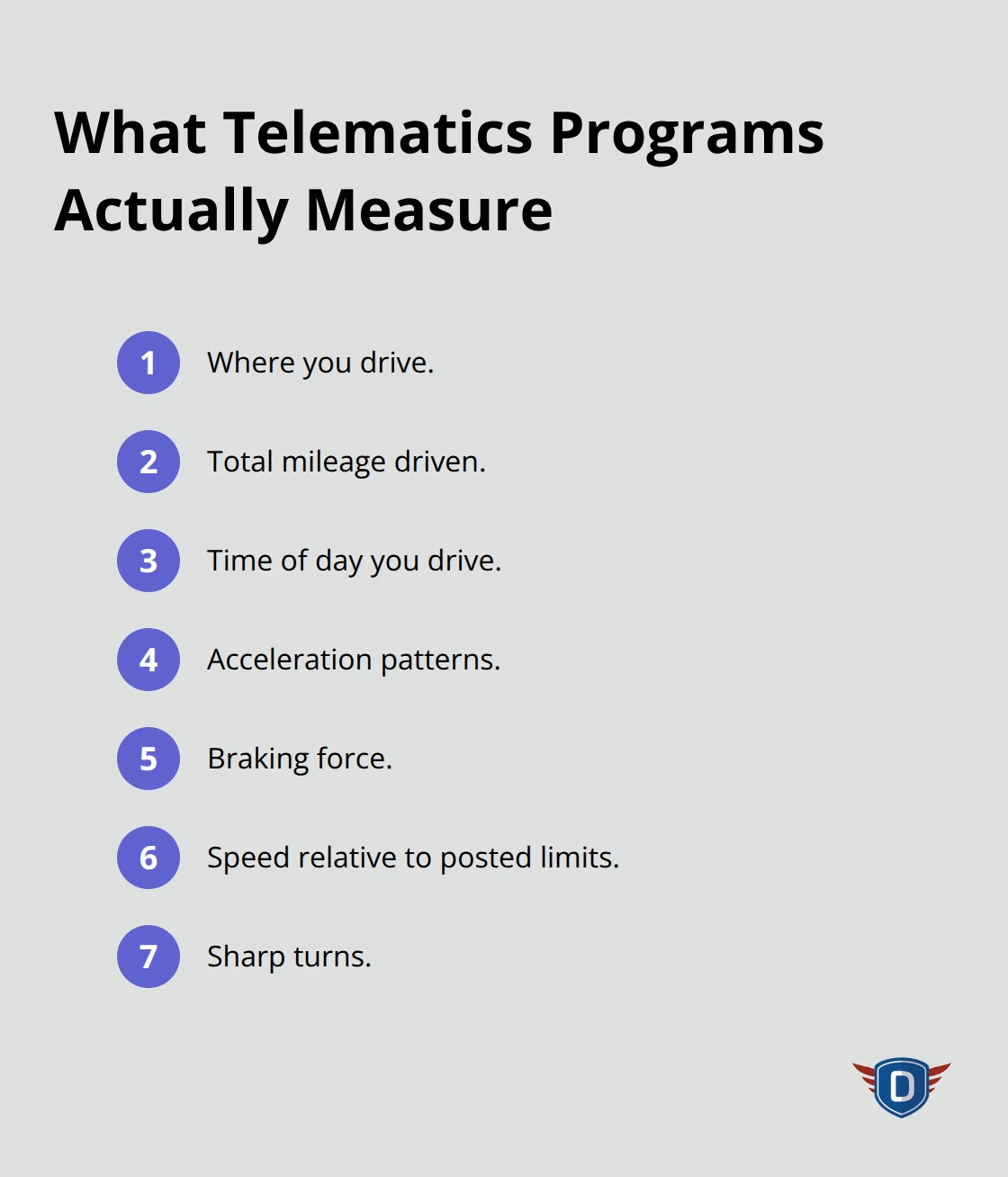

The real value emerges when you compare what you actually save against your current premium. If you pay $1,200 annually and qualify for a 15% reduction, that’s $180 per year, but better drivers frequently earn higher discounts that compound over time. American Family KnowYourDrive, Farmers Signal, Nationwide SmartRide, Travelers IntelliDrive, and USAA SafePilot all track identical metrics: where you drive, mileage, time of day, acceleration patterns, braking force, speed relative to limits, and sharp turns. This data reveals your actual driving patterns rather than relying on crash history or claims alone. Understanding how to save money on car insurance with practical strategies helps you maximize these app-based discounts alongside other available options.

Behavioral Feedback Forces Confrontation with Real Driving Habits

The behavioral feedback from these apps matters more than the discount itself because it forces you to confront your real driving habits. TrueMotion Family and OnMyWay provide dashboards showing exactly when and where you speed, brake hard, or accelerate aggressively, then suggest concrete improvements tied to your specific locations and times. If you consistently speed on a particular highway at 7 a.m., the app flags this pattern so you can adjust your morning commute. Research shows that feedback combined with incentives actually changes how people drive, with reductions in speeding, hard braking, and rapid acceleration. OnMyWay takes this further by paying drivers per mile when their phone stays locked, creating an immediate financial incentive that addresses distracted driving directly.

Teen Drivers Respond to Objective Data Rather Than Subjective Arguments

Teen drivers see the largest behavioral shifts because parents can set boundaries through apps like SAFE 2 SAVE and Safest Driver, monitoring whether their teen accelerates too hard or drives during high-risk hours. Parents receive notifications if safety settings are disabled, giving them objective data to discuss driving habits rather than relying on subjective observations. The data-driven approach works because it removes emotion from the conversation and shows exactly which behaviors need correction. This objective evidence transforms how families talk about driving safety, replacing arguments with facts that both parents and teens can see on their screens.

Vehicle Integration Prevents New Distractions While Reducing Old Ones

Vehicle integration is advancing rapidly, with modern apps syncing to dashboard displays and vehicle systems to provide warnings that don’t require checking your phone. This integration prevents the ironic problem of reducing distracted driving by creating a new distraction through app notifications. Apps that connect to your vehicle’s CAN bus can access real-time information about speed, acceleration, and braking patterns directly from onboard sensors rather than relying on smartphone accelerometers alone. This produces more accurate data and reduces the battery drain on your phone. The combination of accurate behavioral feedback, financial incentives, and vehicle integration creates a system where safer driving becomes the obvious choice rather than a chore. You’re not following vague safety advice; you’re responding to data about your specific driving patterns with concrete savings as the reward.

The next step involves selecting an app that aligns with your vehicle, device, and privacy preferences-a decision that requires understanding what data these apps actually collect and how they protect it.

Which Driver Safety App Actually Fits Your Life

Check Compatibility With Your Vehicle and Phone First

Selecting a driver safety app requires matching three practical factors: whether it works with your specific vehicle and phone, how it handles your location and driving data, and whether real drivers report it actually functions as advertised. The wrong choice wastes money on discounts you can’t access or installs an app that drains your battery and conflicts with your vehicle’s systems. Most apps like Progressive Snapshot, State Farm Drive Safe & Save, and Geico DriveEasy work on both Android and iOS, but some require specific vehicle model years or won’t function if your car lacks onboard diagnostic ports. Contact your insurer directly and ask whether their telematics program uses a hardware plug-in device that connects to your vehicle’s OBD-II port, a smartphone app that relies on your phone’s sensors, or both options. Hardware devices typically provide more accurate data because they read directly from your vehicle’s computer rather than depending on smartphone accelerometers, but they require your vehicle to have a compatible diagnostic port manufactured after 1996. Older vehicles might force you toward app-only solutions, while newer cars often support both. Check your phone’s operating system version too because some apps require Android 10 or iOS 15 minimum, and older devices won’t run them regardless of compatibility with your vehicle.

Understand What Data These Apps Collect and How Companies Protect It

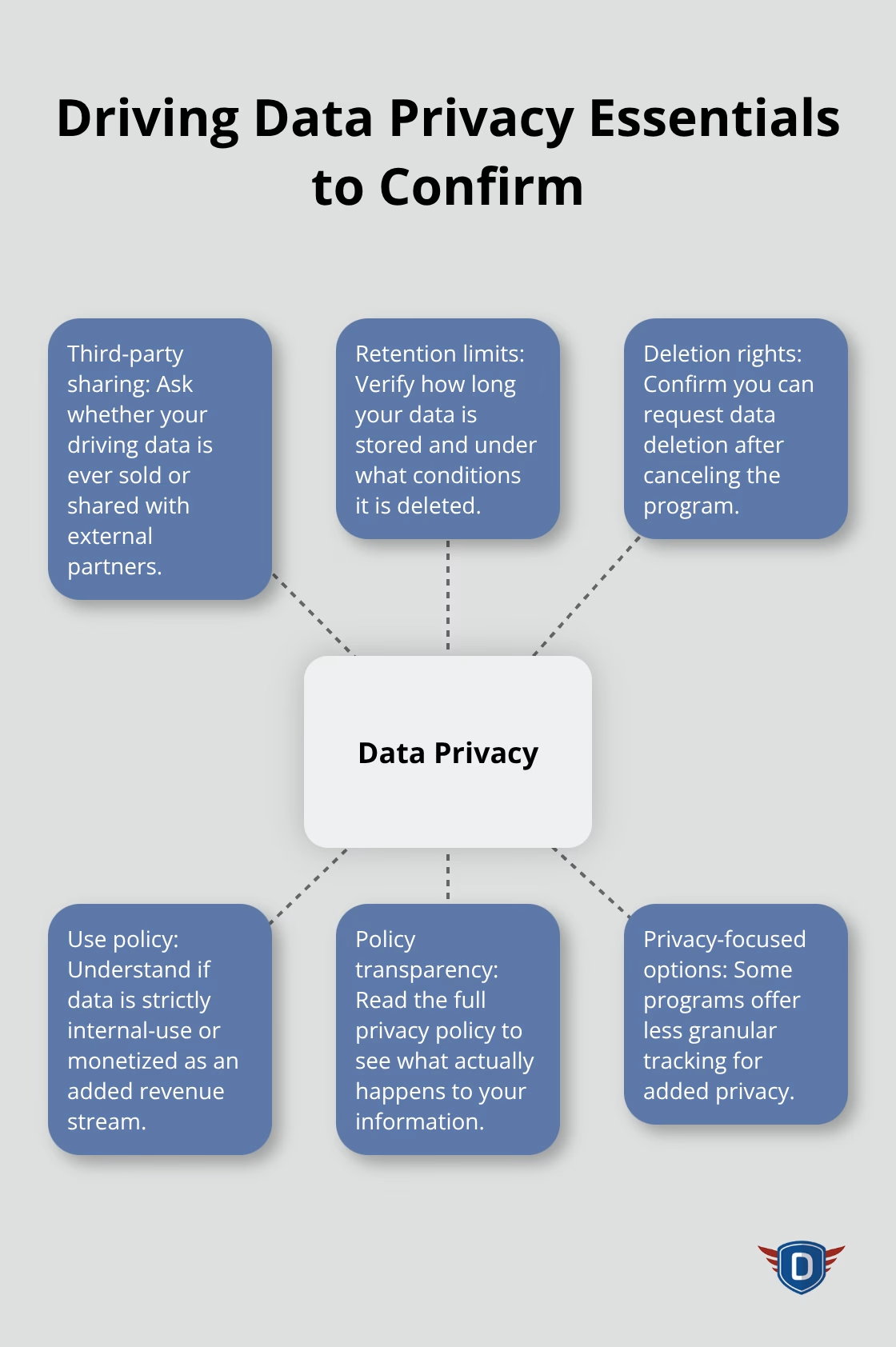

Data privacy concerns separate careful drivers from those who ignore how much information these apps collect. Apps track your exact location throughout every trip, the times you drive, which routes you take, how hard you brake, and how fast you accelerate in specific locations. Insurers aggregate this data to calculate discounts, but it also reveals your home address, workplace location, and driving patterns to the company operating the app. Before you install anything, contact your insurer and ask explicitly whether they sell or share your driving data with third parties, how long they retain it, and whether you can request deletion after you cancel the program. Some carriers maintain strict internal-use policies while others monetize telematics data as a secondary revenue stream. Read the app’s privacy policy directly rather than relying on marketing claims because the legal language reveals what actually happens to your information.

If location tracking concerns you, some programs like Liberty Mutual RightTrack offer privacy-focused versions that collect less granular data.

Read Recent User Reviews to Spot Real Problems

User reviews on the Google Play Store and Apple App Store reveal real problems that marketing materials hide. Look specifically for complaints about battery drain, which indicates the app constantly uses GPS and sensors that exhaust your phone’s power within hours. Read recent reviews from the past three months because app updates change performance significantly, and a one-star review from two years ago might describe a problem that no longer exists. Pay attention to reviews that mention crashes or false alerts because an app that incorrectly detects hard braking when you’re actually just hitting a pothole will frustrate you constantly and create noise in your driving data. Drivers who report consistent false alerts waste time disputing inaccurate data that affects their discount calculations. Reviews that highlight specific vehicle models (such as “works great on my 2022 Honda but crashes on my wife’s 2019 Toyota”) help you predict whether the app will function properly on your particular car. Try apps that earn consistent four-star or higher ratings across hundreds of recent reviews rather than those with fewer reviews or volatile ratings that swing between one and five stars.

Compare Discount Structures Across Multiple Insurers

The discount structure matters more than you might think because different carriers calculate savings in different ways. Some insurers calculate savings based on sustained safe behavior over months, while others reward immediate improvements. Contact your insurer to understand exactly how their program calculates discounts and whether you need to maintain certain driving standards to keep the savings active. Ongoing safe driving is often required, meaning lapses in behavior can reduce or eliminate benefits. The real value emerges when you compare what you actually save against your current premium. If you pay $1,200 annually and qualify for a 15% reduction, that’s $180 per year, but better drivers frequently earn higher discounts that compound over time. American Family KnowYourDrive, Farmers Signal, Nationwide SmartRide, Travelers IntelliDrive, and USAA SafePilot all track identical metrics: where you drive, mileage, time of day, acceleration patterns, braking force, speed relative to limits, and sharp turns. This data reveals your actual driving patterns rather than relying on crash history or claims alone. Work with an independent insurance agent who represents multiple carriers because they can compare discount structures across programs and help you identify which combination of coverage and telematics savings produces the lowest total cost. You can also explore how to save money on car insurance with practical strategies beyond telematics programs.

Verify the App Integrates With Your Vehicle’s Systems

Vehicle integration is advancing rapidly, with modern apps syncing to dashboard displays and vehicle systems to provide warnings that don’t require you to check your phone. This integration prevents the ironic problem of reducing distracted driving by creating a new distraction through app notifications. Apps that connect to your vehicle’s CAN bus can access real-time information about speed, acceleration, and braking patterns directly from onboard sensors rather than relying on smartphone accelerometers alone. This produces more accurate data and reduces the battery drain on your phone. Before you commit to an app, verify whether it works with your vehicle’s infotainment system and whether notifications appear on your dashboard rather than your phone screen. The combination of accurate behavioral feedback, financial incentives, and vehicle integration creates a system where safer driving becomes the obvious choice rather than a chore.

Final Thoughts

Driver safety apps deliver measurable results: lower insurance premiums, concrete behavioral feedback, and automatic crash detection that saves lives. The data proves these tools work because they combine financial incentives with objective data about your actual driving patterns, forcing real change rather than relying on vague safety advice. Vehicle integration continues advancing, with modern apps syncing to dashboard displays so warnings appear on your windshield instead of your phone screen, preventing the ironic problem of creating new distractions while reducing old ones.

However, driver safety apps work best when paired with formal driver education. Apps provide feedback about your specific habits and patterns, but they don’t teach you the foundational skills that prevent accidents in the first place. Understanding right-of-way rules, recognizing hazards before they become emergencies, and developing defensive driving techniques require structured instruction from certified professionals.

At DriverEducators.com, we provide comprehensive driver education programs that teach these essential skills while building the safe driving habits that apps then reinforce and reward. Our Florida-approved courses cover defensive driving techniques, crash avoidance strategies, and the decision-making skills that keep you safe when technology isn’t available. When you combine formal driver education with driver safety apps, you create a complete safety system where education teaches you how to drive safely and apps monitor your progress and reward your improvements.