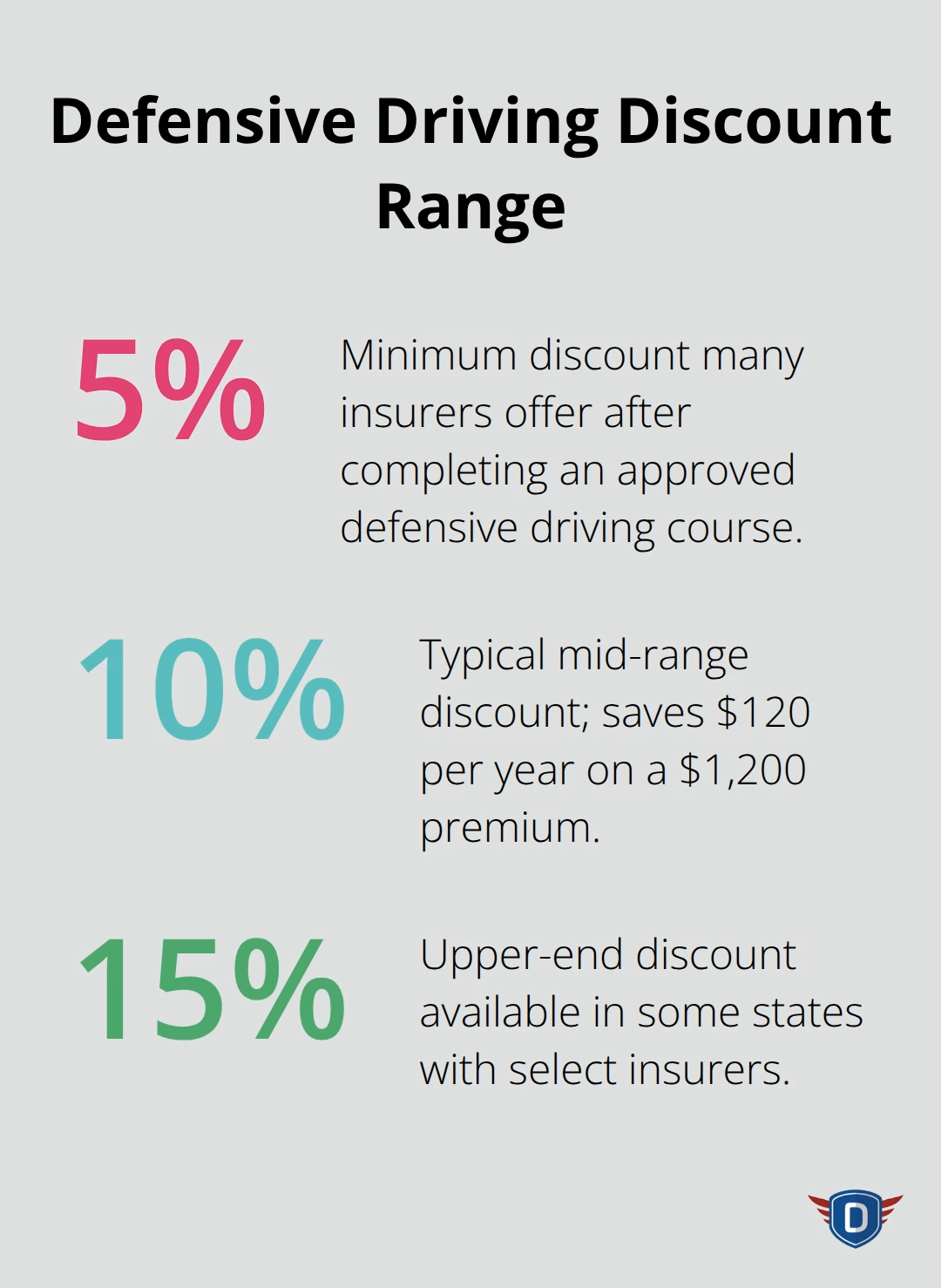

Insurance companies know that defensive drivers file fewer claims. That’s why they offer a discount for defensive driving-sometimes cutting your premium by 5% to 15%.

At DriverEducators.com, we help Florida drivers access approved traffic school courses that qualify for these savings. Complete certification, report it to your insurer, and watch your rates drop.

Why Insurers Cut Rates for Defensive Drivers

Insurance Companies Reward Lower Risk

Insurance companies operate on data. They know that drivers who complete defensive driving courses file significantly fewer claims than those who don’t. Defensive driving discounts can provide multi-year savings on your auto insurance. This isn’t a marketing gimmick-it’s based on hard actuarial evidence. Insurers have decades of claims data showing that drivers who take these courses demonstrate safer behaviors, fewer accidents, and lower overall risk. When you complete an approved course, you prove to your insurer that you’ve invested time in becoming a safer driver, and they reward that commitment by lowering your rates.

How Much You Actually Save

The math works differently depending on where you live and which insurer you use. GEICO offers discounts ranging from 5% to 15% depending on your state, with Alaska and Arkansas at the top of the range. State Farm, The Hartford, USAA, and AAA all participate in this discount structure, though amounts vary. If you pay $1,200 annually for car insurance, a 10% discount saves you $120 per year.

Over several years-the typical length of a defensive driving discount-that’s substantial savings in direct savings. Many drivers overlook the second benefit: the skills you learn actually reduce your accident risk, which means lower claims and potentially better renewal rates after the discount period ends.

Skills That Protect You Beyond the Discount

Defensive driving courses teach practical techniques that stick with you long after certification. You’ll learn proper following distances, how to handle left turns and right-of-way situations, and strategies to avoid distracted driving-techniques that insurance companies recognize as genuinely protective. These skills lower your collision risk, which translates to fewer claims filed and better rates when your discount period expires. A course that costs between $20 and $50 pays for itself within months through premium reductions alone. The real value emerges over time as you apply these defensive techniques on every drive, reducing your exposure to accidents and the financial consequences that follow.

Getting Your Defensive Driving Certification in Florida

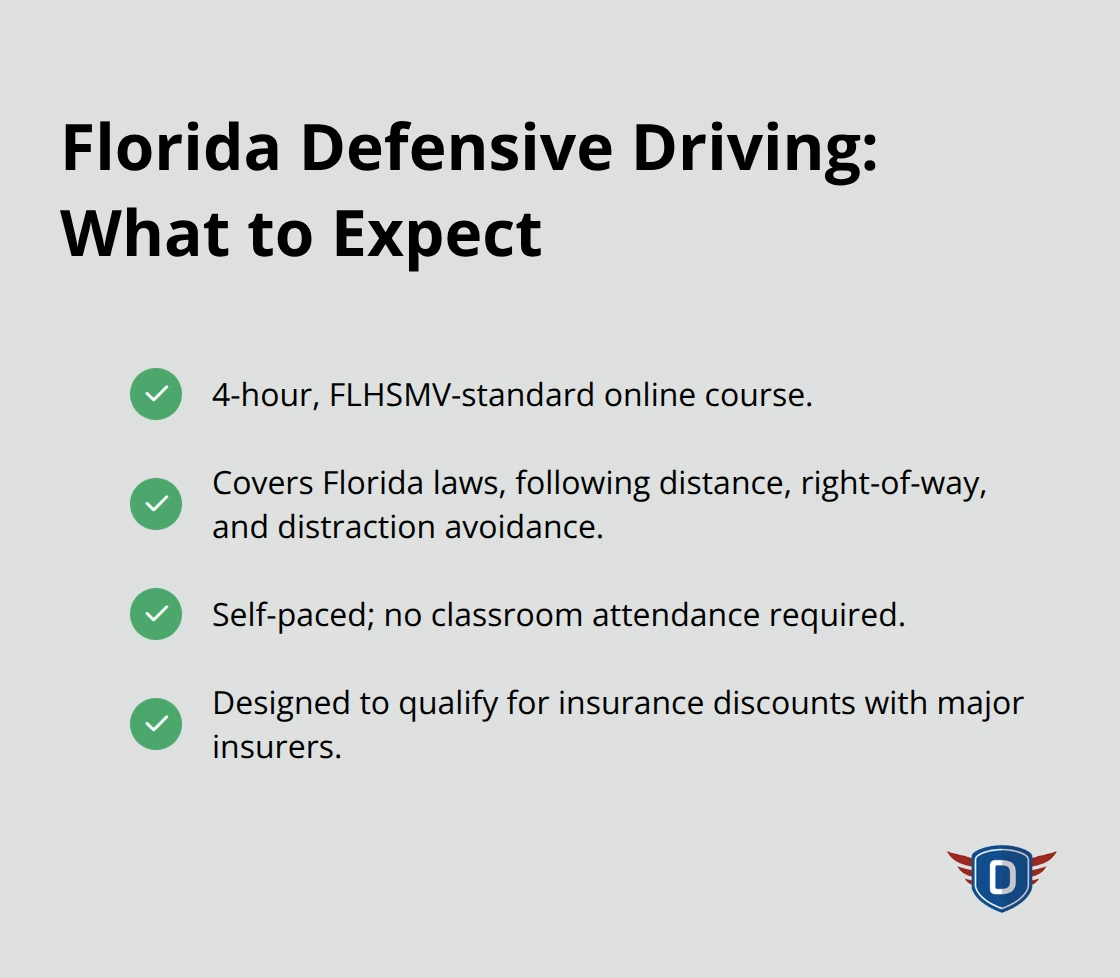

Florida’s Strict Course Standards

Florida requires that any course qualifying for insurance discounts meet strict standards set by the Florida Department of Highway Safety and Motor Vehicles (FLHSMV). At DriverEducators.com, our Basic Driver Improvement course is a 4-hour program designed specifically to help drivers access insurance discounts while mastering defensive techniques that actually reduce accident risk. The course covers Florida traffic laws, safe following distances, right-of-way rules, and strategies to avoid distracted and aggressive driving. You complete it entirely online at your own pace, meaning you fit certification around your schedule rather than attending fixed classroom times.

How the Certification Process Works

After you finish the course, your certificate is reported electronically directly to FLHSMV, so there’s no paperwork hassle on your end. Most drivers complete the full course in a single day, though you have flexibility to spread it across multiple sessions. The certification process matters because your insurer won’t recognize just any course. GEICO, State Farm, The Hartford, and USAA all require that your course come from an FLHSMV-approved provider, and only approved certificates count toward your discount.

Submitting Your Certificate to Your Insurer

When you complete an approved program, the certificate goes straight to the state database, giving you proof to submit to your insurer. Some insurers like GEICO allow you to upload your certificate directly through your online account and receive your discount within days. Others may require a phone call or written submission. The key is contacting your insurer before you enroll to confirm exactly which courses they accept and what documentation they need. This five-minute conversation prevents wasting time on a course that won’t qualify.

Discount Duration and Renewal Options

Once approved, your discount typically locks in for three years, meaning you’re protected through multiple renewal cycles. After that period ends, you can retake the course to maintain the savings if you still qualify under your insurer’s age and driving record requirements. This flexibility allows you to extend your savings indefinitely as long as you meet your insurer’s ongoing eligibility criteria. The next step involves understanding how to combine this discount with other savings opportunities available to you.

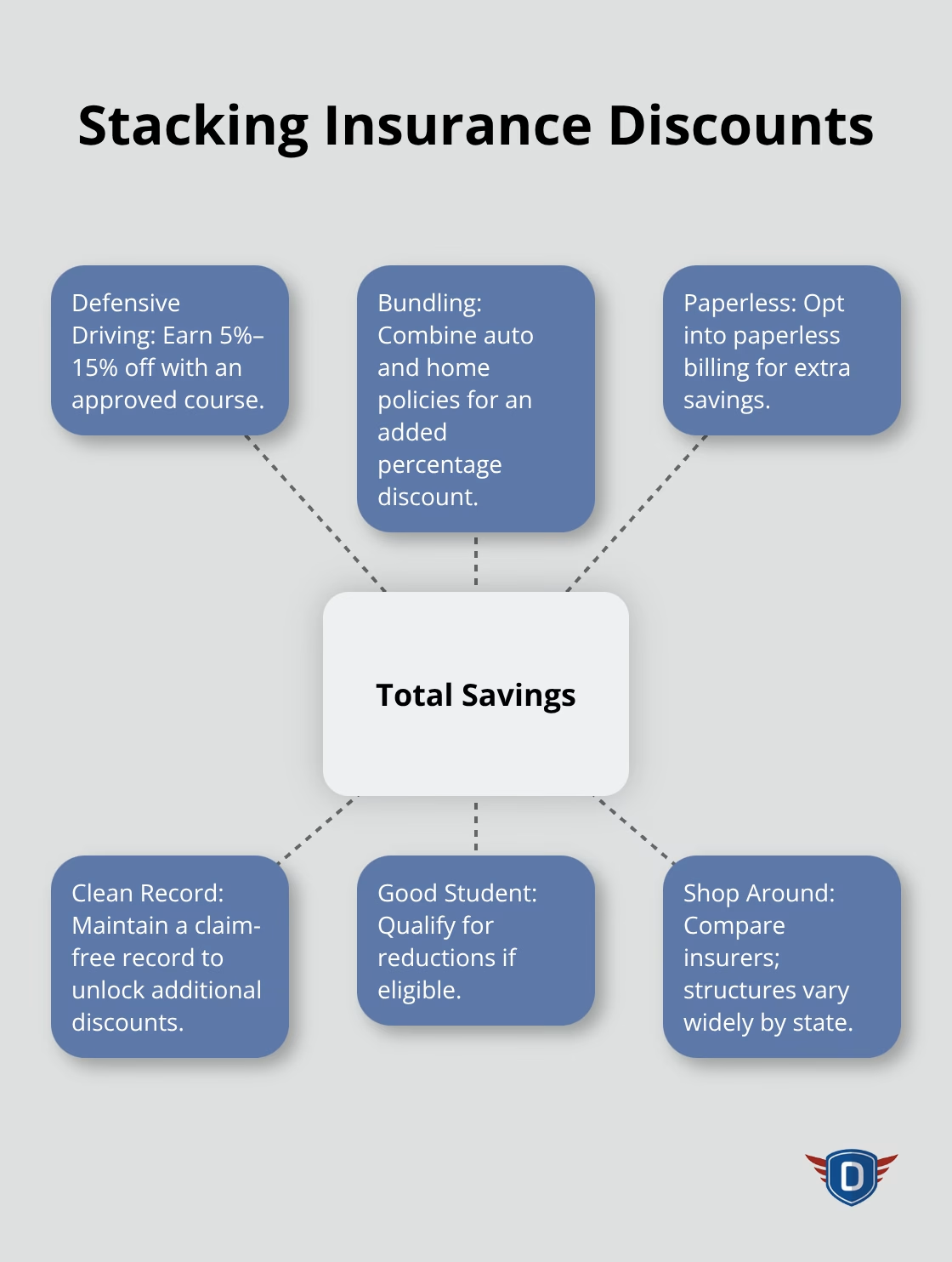

Stacking Your Defensive Driving Discount with Other Savings

Combine Multiple Discounts for Maximum Savings

Your defensive driving discount is powerful on its own, but it’s far from your only opportunity to reduce what you pay. Insurance companies layer discounts, meaning you can combine your 5% to 15% reduction from completing a course with savings from bundling auto and home policies, maintaining a clean driving record, going paperless, or qualifying for good student discounts if applicable.

The real money comes from shopping around after you’ve locked in your defensive driving certification. GEICO, State Farm, The Hartford, USAA, and AAA all offer defensive driving discounts, but their other discount structures vary significantly by state. If you’re paying $1,200 annually and stack a 10% defensive driving discount with a 15% bundling discount and a 5% paperless discount, you’re looking at roughly $360 in annual savings rather than just $120.

Most drivers complete a course and stop there, assuming they’ve maximized their savings. That’s only the foundation. After you receive your FLHSMV certificate, contact your insurer and ask specifically which other discounts you qualify for and what the exact percentages are. Some insurers stack discounts freely while others cap combined savings at a certain percentage, so knowing the rules matters before you commit to other changes like switching your home policy.

Protect Your Eligibility Through Safe Driving

Your driving record determines whether you stay eligible for these discounts over time, and the standards are stricter than most drivers realize. USAA requires no at-fault accidents in the previous 34 to 35 months to maintain eligibility, which means a single preventable accident can cost you not just the claims payout but also the loss of your discount for years. If you’re paying $1,200 annually with a 10% defensive driving discount, losing that discount due to an accident costs you $120 per year, but the actual financial damage extends far beyond the discount itself. Your rates jump after an accident regardless of whether you have the discount, sometimes by 20% to 40% according to insurance industry data.

This is why the defensive techniques you learn in approved courses matter so much in practice. The three-year discount period gives you a window to prove you can drive without claims, and if you succeed, many insurers allow you to retake the course and renew your discount indefinitely.

Plan Ahead for Discount Renewal

The renewal process is straightforward: once your three years expire, contact your insurer about retaking an approved course if you still meet their age and driving record requirements. Some insurers like GEICO make this simple by allowing online certificate submission through your account, while others require a phone call. The key is not waiting until your discount expires to plan ahead. Set a calendar reminder six months before your three-year period ends so you can enroll in a refresher course and maintain uninterrupted savings (this timing prevents gaps in your discount coverage and keeps your rates low across multiple renewal cycles).

Final Thoughts

Defensive driving discounts deliver real money back into your pocket-a 5% to 15% reduction on your annual premium adds up quickly, especially when you stack it with bundling discounts and other savings opportunities. Over three years, that discount for defensive driving could save you $360 to $1,080 depending on your current premium and insurer. The math alone justifies taking a four-hour course.

What matters more is what happens after you complete the certification. The defensive techniques you learn-proper following distances, anticipating hazards, managing distractions-become habits that protect you every time you drive. These skills reduce your actual accident risk, which means fewer claims, lower rates after your discount expires, and genuine safety improvements that benefit you and everyone sharing the road. Your insurer recognizes this value, which is why they offer the discount in the first place.

Contact your insurer today and confirm they offer a defensive driving discount and which courses they accept. Then enroll in an FLHSMV-approved program and complete it at your own pace. You’ll receive your certificate electronically, submit it to your insurer, and watch your rates drop within days.