As a Florida driver, you have a straightforward way to knock down your auto insurance premiums, and it all starts with a simple online course. Getting a defensive driving insurance discount isn't just a savvy financial decision—it's a real investment in your own safety and confidence behind the wheel.

Let’s walk through the entire process, from finding the right course to seeing that discount on your bill.

Your Path to a Defensive Driving Insurance Discount

High insurance costs can feel like just another part of living in Florida, but you’ve got more power to change that than you might realize. When you voluntarily complete a state-approved driving course, you’re sending a clear signal to your insurance company: you're a lower-risk driver.

Why does this work? The skills you brush up on—things like spotting hazards early and navigating tricky traffic situations—directly translate to fewer accidents and tickets. For an insurer, that means you're less likely to file a claim, and they’re happy to pass some of those potential savings back to you.

This isn't some hidden trick; it's a standard industry practice. Most major insurance carriers offer these discounts, which typically fall somewhere between 5% to 20%. In Florida, there's even a mandatory discount for drivers aged 55 and older who complete an approved course, often netting them up to 10% off each year for three years straight.

Understanding the Process

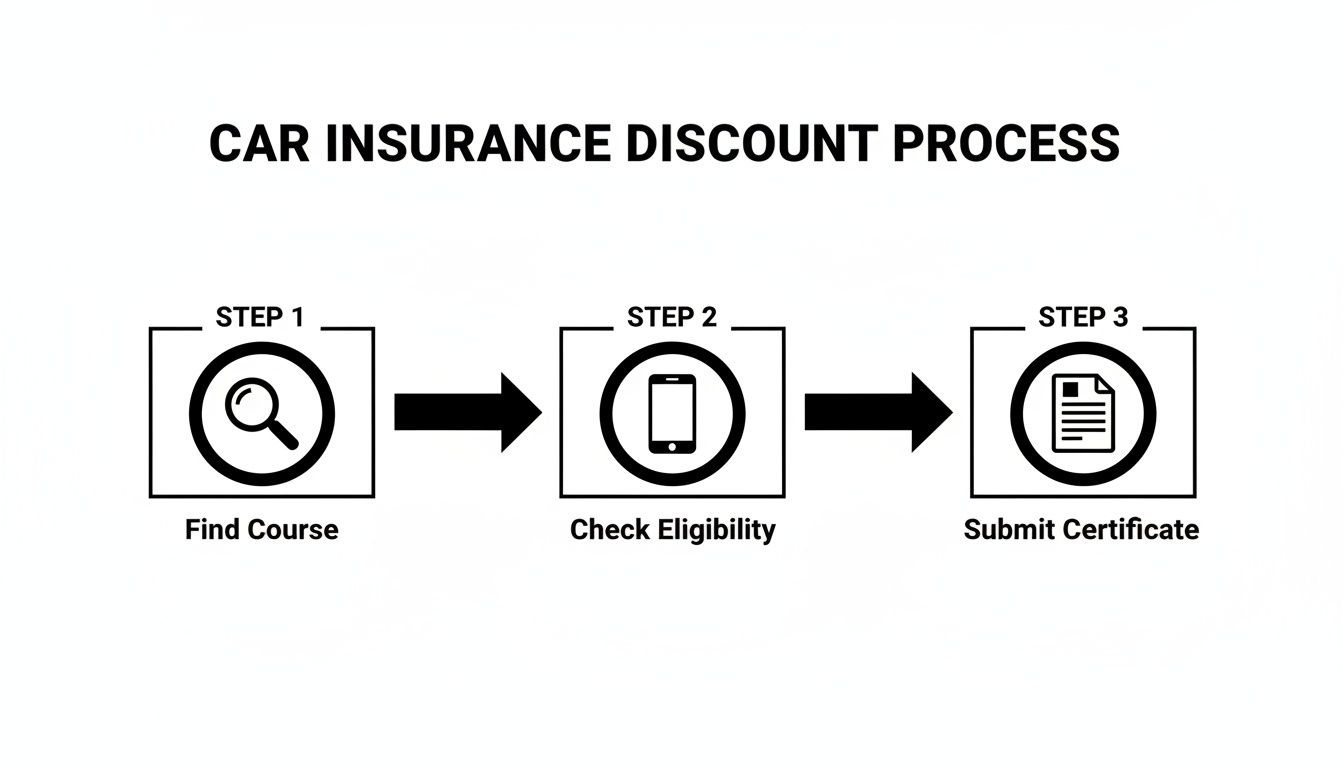

The journey to getting your discount is surprisingly simple. It really boils down to three key stages: finding the right course, making sure you qualify with your insurer, and then sending them your completion certificate. Each step is easy, but getting the details right ensures you won't hit any snags.

This visual gives you a quick snapshot of the three-step path to lowering your premium.

As you can see, it's a direct route from signing up to saving money. A few deliberate actions are all it takes.

Why Insurers Reward Safe Driving

At its core, insurance is a numbers game about managing risk. By completing a course from a Florida Highway Safety and Motor Vehicles (FLHSMV) approved provider like BDI School, you're actively lowering your risk profile in their eyes. The curriculum is designed to make you a more attentive and prepared driver.

You'll typically cover essential topics like:

- Crash Avoidance Techniques: This is all about learning to see and react to potential trouble on the road before it turns into an emergency.

- Florida Traffic Law Refreshers: Rules change, and this ensures you're up-to-date, helping you avoid common (and costly) tickets.

- Understanding Distractions: You’ll get a stark reminder of the real dangers of distracted or impaired driving and practical ways to stay focused.

By putting in just a few hours, you're showing a commitment to safety that insurance companies are eager to reward. If you want to dive deeper into the nuts and bolts of this, check out our guide on how to lower car insurance rates. It’s a proactive move that saves you money and helps make Florida's roads safer for everyone.

Making Sure You Qualify and Picking the Right Course

Before you jump into a course, your very first step should be a quick call to your insurance provider. It's a simple but crucial move.

While most Florida insurers offer a defensive driving insurance discount, the specifics can vary based on your individual policy and driving record. A five-minute chat can save you the headache of completing a course your provider won't even recognize.

What to Ask Your Insurance Agent

When you get your agent on the phone, you want to be direct and get the full picture. Don't leave things to chance.

Make sure you get solid answers to these questions before you hang up:

- What’s the exact discount I can expect? Is it 5%, 10%, or even as high as 20%? Knowing the number lets you see the actual savings.

- Which specific courses do you accept? You’ll want to confirm they approve programs from FLHSMV-approved providers like BDISchool.

- Are there any other catches? Ask if your driving record, age, or policy type plays a role in qualifying.

- How long will the discount stick around? It’s usually good for three years in Florida, but it's always smart to double-check.

Honestly, this one call is the most important part of the whole process. It ensures the time you're about to spend will actually lead to a lower bill.

Finding the Course That Fits Your Needs

Once you've gotten the green light from your insurer, it's time to pick the right program. Not all defensive driving courses are created equal—they're often designed for different situations.

Let's say you just got a speeding ticket. This is a perfect example of a two-for-one opportunity. By enrolling in a 4-hour Basic Driver Improvement (BDI) course, you can keep points off your license and get that insurance discount with the same certificate. It's a smart play. You can learn more about how an online defensive driving course in Florida works to see if it's the right fit.

For drivers 55 and older, the choice is even clearer. The 6-hour Mature Driver course is built specifically for them, and completing it often unlocks a state-mandated insurance discount.

Choosing the right course isn’t just about checking a box. It’s about being strategic and getting the most bang for your buck based on where you’re at.

Getting Started: Enrolling and Cruising Through Your Course

You've confirmed you're eligible and picked out the right course. Now for the easy part. Getting signed up with an FLHSMV-approved provider like BDISchool is a piece of cake—you can be up and running in just a few minutes.

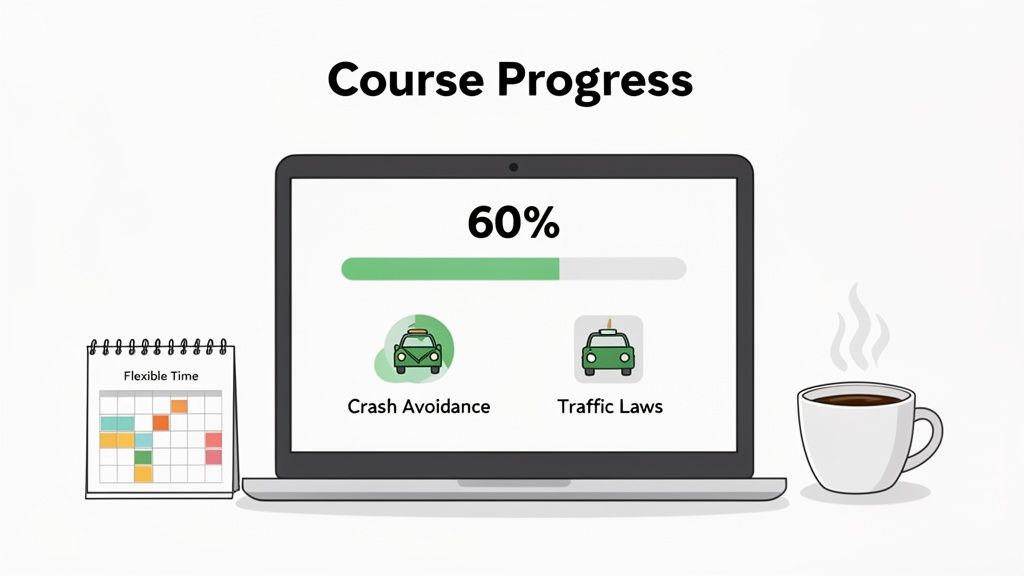

The best thing about these online programs is that they are built around your schedule. You're in complete control. Squeeze in a chapter during your lunch break, log on after you've put the kids to bed, or chip away at it on a lazy Sunday morning. You don’t have to blow up your whole week just to earn that defensive driving insurance discount.

How to Actually Learn and Retain the Material

Okay, you're in. The goal isn't just to click "next" until you see the finish line. It's to walk away a smarter, safer driver. The top courses know this, and they mix things up with text, quick videos, and little interactive quizzes to keep your brain from going numb.

Here are a few tips I've seen work for thousands of drivers:

- Don't Binge-Watch: A 4-hour or 6-hour course sounds like a lot. Break it up. Tackle it in 30- or 60-minute chunks. This helps you actually remember the finer points of Florida traffic laws instead of just cramming for the final quiz.

- Take Some Notes: It might feel like school, but writing down a few key points—especially on things like crash avoidance techniques or tricky right-of-way scenarios—really helps lock the information in.

- Go into a Bubble: Find a quiet spot, put your phone on silent, and close out of social media. Even 15-20 minutes of focused time is way more effective than an hour of distracted clicking.

This isn’t about passing a test; it’s about building instincts that keep you safe on the road.

The single most valuable skill these courses teach is how to anticipate what other drivers are going to do. You learn to stop just reacting to traffic and start actively managing the space around your car to shut down problems before they even start.

Making the Most of the Course Platform

Today's online driving courses are way more than just a digital book. They have built-in tools designed to help you succeed.

For example, most modules wrap up with a short review quiz. Don't just blow past these. They're your personal progress report. If you get a question wrong, it’s a flashing light telling you to hop back and re-read that section before you move on.

Keep an eye out for a progress tracker or dashboard, too. Watching that completion bar fill up is surprisingly motivating. It keeps you on track, pushing you toward that final test and the insurance discount you’ve earned.

Submitting Your Certificate to Secure Your Discount

Passing that final quiz feels great, but hold on—you’re not quite done yet. The real win, your defensive driving insurance discount, doesn't actually kick in until you let your insurance company know what you’ve accomplished. Your completion certificate is the golden ticket to unlocking that lower premium.

Luckily, reputable state-approved providers like BDISchool make this next part a breeze. You’ll usually get an electronic copy of your certificate in your email almost as soon as you pass. I always recommend saving a digital copy right away and even printing a hard copy for your files. A little organization now can save you a lot of hassle later.

How to Send Your Certificate

Most insurance carriers these days give you a few simple ways to get your documents to them. The key is to choose a method that’s quick and provides a clear record that you sent it.

Here are the most common ways to get it done:

- Insurer's Online Portal: This is usually my first choice. Logging into your account and using their document upload tool is often the fastest, most direct route.

- Email to Your Agent: A quick email with the certificate attached works perfectly. It creates a digital paper trail and puts the document directly in the hands of someone you already have a relationship with.

- By Mail: It's slower, but sending a physical copy is still a perfectly fine option. If you go this route, I strongly suggest sending it with tracking to be certain it arrives safely.

Whichever method you pick, never just send the certificate by itself. You need to include a clear, simple message to make sure it gets processed without any frustrating delays.

What to Say in Your Message

You don't need to write a novel. A short and sweet professional note is all it takes.

Subject: Defensive Driving Discount Certificate – [Your Full Name] – Policy #[Your Policy Number]

Body:

Hello,I’ve just completed an FLHSMV-approved defensive driving course to qualify for an insurance discount. I've attached my certificate of completion for your records.

Could you please apply the discount to my policy and let me know once it's active?

Thanks so much,

[Your Full Name]

This little template gives them everything they need at a glance: who you are, what you need, and the proof required to make it happen.

After you hit send, put a reminder on your calendar to follow up with a quick phone call in about a week. This just confirms they got it and that your new, lower rate is locked in. Before you submit, it's also a smart time to learn more about how to check your driving record to make sure everything is looking clean and accurate.

Maximizing Your Savings for the Long Haul

Getting that initial defensive driving insurance discount is a great win, but the real payoff comes from thinking long-term. This isn't just about a one-time price drop; it’s about preventing future rate hikes. The skills you pick up are your best defense against a rising premium because they help you maintain a clean driving record—the holy grail for low insurance rates.

Think about it: every ticket or fender bender you avoid is money in your pocket. From an insurer's perspective, a driver who constantly files claims or gets pulled over is a major red flag. By using what you've learned, you prove you're a low-risk client, and that's a status that keeps paying you back, year after year.

The Lasting Impact of Safe Driving Skills

The data doesn't lie. One study found that drivers who completed an online safety course saw their traffic violation rates plummet by as much as 74% in the following year. It’s these kinds of lasting changes in driver behavior that convince insurance companies to reward you.

Fewer tickets almost always mean fewer accidents. A cleaner record protects you from the sudden, steep premium increases that inevitably follow a mishap on the road.

Keeping Your Discount Active

Here in Florida, your insurance discount is good for three years. After that, it quietly disappears from your policy, and you’ll see your premium creep back up. Don't let that happen.

My best advice is simple: set a calendar reminder. Seriously. Put an alert on your phone for two months before your three-year discount anniversary. That gives you more than enough time to sign up for a refresher course, complete it, and get the new certificate to your agent without any gap in your savings.

This one small, proactive step is one of the easiest ways to lower your car insurance and keep it low. A couple of hours every three years can easily add up to hundreds of dollars in savings.

Beyond just the course, it helps to understand the bigger picture. Gaining insights into the insurance industry can give you a better sense of how companies assess risk and set their prices. When you combine safe driving habits with a bit of industry knowledge, you're putting yourself in the driver's seat to secure the best rates for years to come.

Common Questions About Florida Insurance Discounts

Diving into the world of insurance discounts can feel a bit murky, but the path to savings is usually pretty straightforward. Let's tackle some of the most frequent questions we hear from Florida drivers who want to turn a defensive driving course into a lower insurance bill.

How Much Can I Actually Save on My Car Insurance?

This is always the first question, and for good reason! While the exact amount depends on your insurance company, most Florida drivers can expect a defensive driving insurance discount between 5% and 20%.

That might not sound like a huge number at first glance, but it really adds up. Think about it: on a $2,000 annual premium, a simple 10% discount puts $200 back in your pocket every year. Since the discount is good for three years, that’s a $600 savings from a course that only takes a few hours.

Drivers 55 and older often benefit from a state-mandated discount that can be as high as 10% annually.

The best way to get a solid number? Call your insurance agent before you sign up for a course. Ask them for the exact percentage they offer for completing a defensive driving class. That way, you know precisely what you're working toward.

Can I Get a Discount if I Recently Got a Traffic Ticket?

Absolutely! This is one of the smartest things you can do after getting a ticket. Completing a 4-hour Basic Driver Improvement (BDI) course can turn that citation into a win-win situation.

First, by electing to take the BDI course, you keep the points from that ticket off your driving record. This is huge, as it prevents your insurance company from jacking up your rates.

Second, you can take that same course completion certificate and send it to your insurer to claim your safe driver discount. It’s a brilliant two-for-one deal that handles the ticket and lowers your premium at the same time. Just make sure you finish the course before the court’s deadline.

How Do I Know if a Driving Course Is State-Approved?

This part is non-negotiable. Your insurance carrier will only honor a certificate from a school that is officially approved by the Florida Department of Highway Safety and Motor Vehicles (FLHSMV). If you use an unapproved school, you've unfortunately wasted your time and money.

Legitimate course providers, like BDISchool, make their state approval status obvious on their website. You can also double-check by looking up the school on the FLHSMV's official list of approved providers online. Sticking with a recognized school guarantees your certificate will be accepted everywhere it needs to be.

How Long Is My Course Certificate Valid for a Discount?

In Florida, your hard-earned discount is typically good for three full years. Once those three years are up, the discount expires, and your premium will likely go back up unless you do something about it.

Here’s a pro tip: as soon as you get your discount, set a calendar reminder for about two and a half years from now. This little nudge gives you plenty of time to find a new course, complete it, and get the new certificate to your agent without any gaps in your savings.

For any questions specific to your policy, the best person to talk to is your insurance agent. They have all the details on your coverage and can give you advice tailored to your situation.

Ready to start saving? BDISchool offers FLHSMV-approved online courses that are convenient, self-paced, and designed to help you secure the insurance discount you deserve. Enroll today at https://bdischool.com and take the first step toward lower premiums.