Your insurance premiums don’t have to stay high. A defensive driving discount in Florida can reduce your bill by 5% to 15% annually, and the savings stack up over multiple years.

At DriverEducators.com, we’ve seen firsthand how completing a state-approved course gives drivers real financial relief. You’ll also knock points off your driving record at the same time.

How Much Can You Save with a Defensive Driving Discount

Real Savings from Florida Discounts

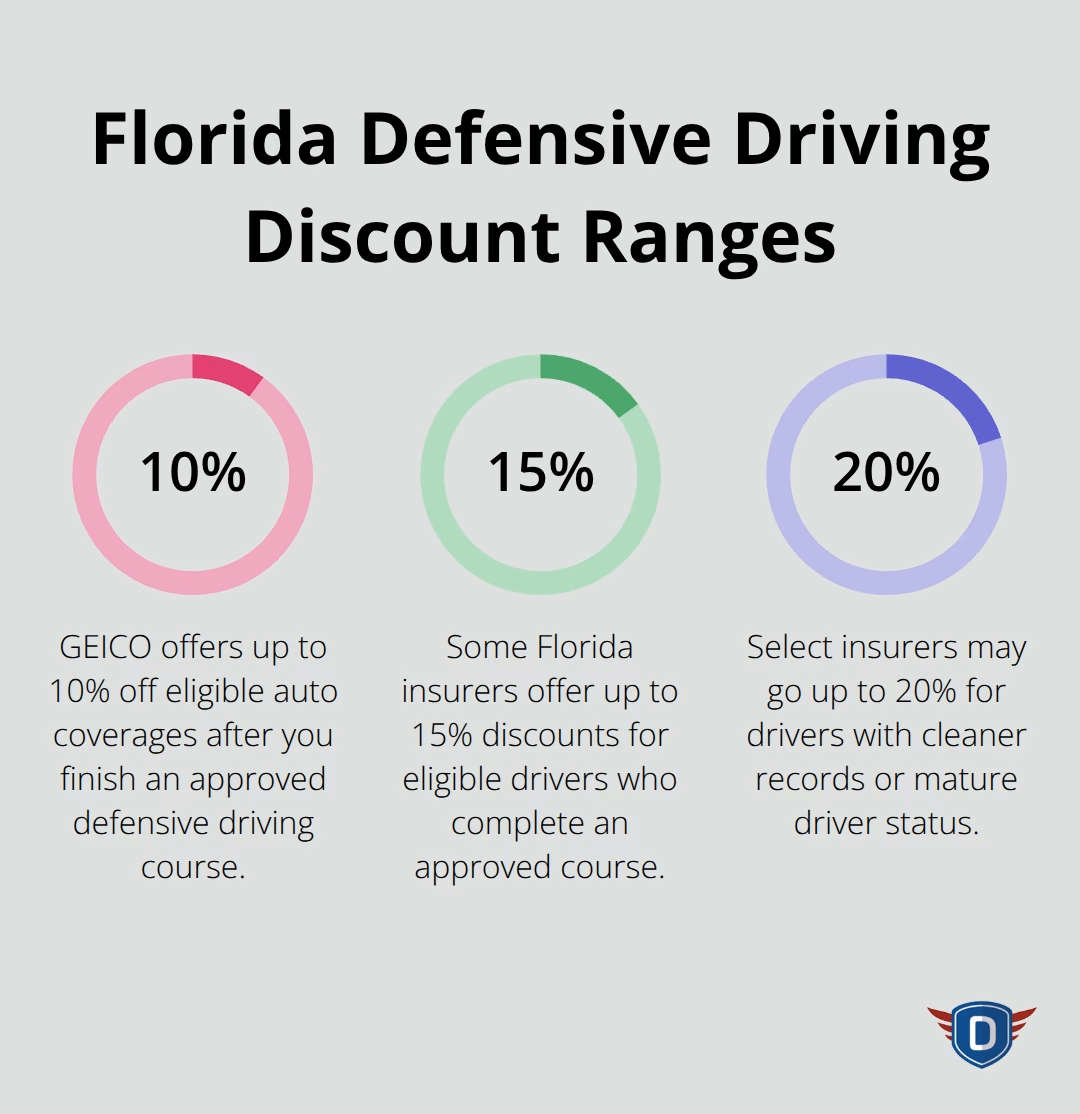

Insurance companies in Florida reward defensive driving course completion with tangible discounts because completing an approved course reduces your statistical risk profile. GEICO offers up to 10% off eligible auto coverages after you finish an approved defensive driving course, while other major insurers like State Farm typically provide 5% to 10% discounts. Your actual savings depend on your current premium and policy details. If you pay $1,500 annually, a 10% discount saves you $150 per year. At $2,000 annually, that same 10% discount puts $200 back in your pocket each year.

Some insurers go higher-Florida drivers with cleaner records or mature driver status can qualify for discounts up to 15% or 20%, translating to $200 to $400 annually on typical premiums.

Three Years of Continuous Savings

Defensive driving discounts in Florida remain active for three full years after course completion, so you don’t need to retake the course annually to keep saving. Once your three-year period ends, you can renew the discount by completing the course again and reset your savings window. The math works simply: a $1,200 annual premium with a 10% discount costs $1,080 instead, saving $120 per year for 36 months. That totals $360 in savings from a single course completion. Over three years, a driver with a $1,500 premium at 10% off accumulates roughly $450 in total savings.

How Your Discount Activates

Your completion certificate gets electronically reported to your insurer, typically within 24 to 72 hours. The discount applies automatically-you don’t need to manually submit paperwork or chase down your insurance company. This streamlined process means your savings start working for you almost immediately after you finish the course. Different insurers process discounts at different times during your billing cycle, so confirm with your agent when your new rate takes effect.

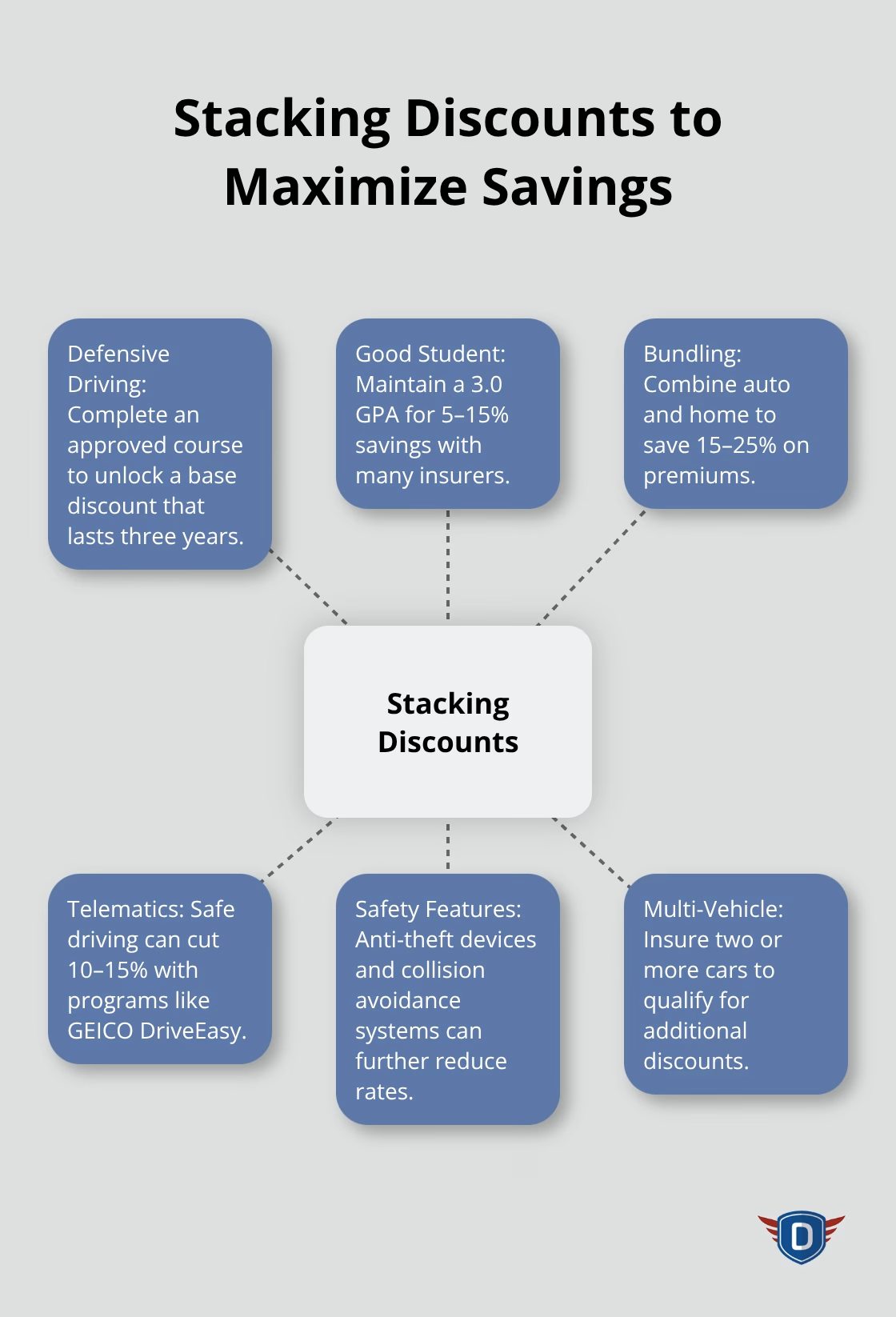

Stacking Savings with Other Discounts

A defensive driving discount works alongside other discounts you may already qualify for. Good student discounts (5–15%), bundling multiple policies, multi-vehicle discounts, and safety feature discounts all combine to lower your total bill. Telematics or usage-based programs can cut premiums by an additional 10–15% if you drive safely. When you layer these discounts together, the cumulative effect becomes substantial. A driver combining defensive driving (10%), good student status (10%), and bundling (15%) can reduce their premium significantly compared to paying full price.

Next Steps to Claim Your Discount

Your path forward involves four straightforward steps: check with your agent about the discount amount and submission process, enroll in a Florida-approved course, complete it at your own pace, and send your certificate to your agent to apply the savings. The sooner you complete your course, the sooner your three-year savings window begins.

Which Courses Qualify for Your Discount

FLHSMV-Approved Programs That Activate Your Savings

Florida’s defensive driving discount requires completion of an FLHSMV-approved course, and your options shift based on your situation and timeline. The state recognizes several program types: the Basic Driver Improvement course runs four hours and targets drivers with a recent moving violation who want to avoid points, the Intermediate Driver Improvement stretches to eight hours for those needing deeper instruction, and the Mature Driver course spans six hours specifically for drivers aged 55 and older seeking to refresh their skills and lock in insurance savings. The course length matters less than completion itself-insurance companies care that you finished an approved program, not whether you took four or eight hours. What matters far more is enrolling in a provider officially listed on the FLHSMV-approved provider list, as courses from unlisted vendors won’t trigger your discount or satisfy court orders.

Online Learning Removes Scheduling Barriers

Online and self-paced learning dominates Florida’s defensive driving landscape because it removes scheduling friction from the process. You can start your course at midnight on a Tuesday and finish during lunch on Wednesday without coordinating with instructors or driving to a classroom. Completion timelines vary based on your pace-some drivers finish a four-hour course in a single sitting, while others spread it across several days. The curriculum covers Florida traffic laws, defensive driving techniques, right-of-way rules, and crash avoidance strategies with clear explanations and real-life scenarios rather than generic lectures. Courses are available in English, Spanish, and Portuguese, so language barriers don’t prevent you from claiming your discount.

Electronic Reporting Speeds Up Your Discount

Your certificate posts electronically to FLHSMV within 24 to 72 hours of completion, and your insurer receives notification automatically-no printing, scanning, or mailing required. This digital pipeline means your discount activation depends entirely on finishing the course, not on bureaucratic delays or lost paperwork. Different insurers process discounts at different times during your billing cycle, so confirm with your agent when your new rate takes effect. Once your completion data reaches FLHSMV and your insurer, the three-year savings window begins immediately, putting money back in your pocket at your next renewal.

Stacking Discounts to Maximize Your Savings

Combine Multiple Discounts for Substantial Savings

Your defensive driving discount works best when you combine it with other discounts your insurer already offers. Good student discounts run 5–15% if you maintain a 3.0 GPA or higher, bundling auto and home policies saves 15–25%, multi-vehicle discounts apply when you insure two or more cars, and safety feature discounts reward anti-theft devices or collision avoidance systems. Telematics programs like GEICO DriveEasy cut premiums by 10–15% when you drive safely, with real-time monitoring proving your low-risk behavior to your insurer. The cumulative effect matters enormously: a driver combining defensive driving (10%), good student status (10%), bundling (15%), and telematics (12%) reduces their total premium by roughly 47% when discounts stack rather than add linearly.

Your insurer calculates the final reduction based on policy rules, but layering these discounts together beats relying on any single one. Ask your agent specifically which discounts you qualify for today and which ones you can unlock within 90 days. Some discounts require proof-your course certificate, school transcripts, policy documents-so gathering documentation upfront prevents delays in applying savings.

Protect Your Discounts Through Safe Driving

Your driving record directly controls whether you keep these discounts or lose them. A single moving violation or accident within your three-year defensive driving discount window doesn’t automatically cancel the discount, but it signals increased risk to your insurer, who may refuse to renew your discount at the next cycle or demand a rate increase elsewhere on your policy. Florida drivers with no crashes or violations for 36 months maintain discount eligibility and often see rates drop further as they age and build clean history.

Shop Annually to Capture Better Rates

Shop around annually at renewal instead of auto-renewing with your current insurer, because competitors frequently offer better rates for your specific profile. A 35-year-old with a clean record and multiple discounts might pay $1,100 annually with one insurer and $950 with another, making the 10-minute quote comparison worth $150 per year. Use online quote tools from major Florida carriers, then call agents directly to confirm discount eligibility and actual out-the-door costs. Rate shopping every 12 months captures competitive pricing shifts and ensures you’re not subsidizing other customers through inflated premiums.

Final Thoughts

A defensive driving discount in Florida delivers real money back into your pocket while strengthening your driving record simultaneously. The math is straightforward: completing an FLHSMV-approved course costs far less than the savings you’ll accumulate over three years, and you avoid points that would otherwise spike your premiums for years to come. Most Florida drivers save between $150 and $400 annually, with the discount renewing every 36 months as long as you retake the course.

You can reduce your total premium by 30% to 50% when you combine defensive driving savings with good student discounts, bundling, telematics programs, and multi-vehicle discounts. Shopping annually for better rates captures competitive pricing shifts that insurers won’t volunteer. Your driving record stays clean, your insurance costs drop, and your confidence behind the wheel improves through the knowledge you gain.

We at DriverEducators.com offer FLHSMV-approved courses that are fully online, self-paced, and available in English, Spanish, and Portuguese (whether you need a four-hour Basic Driver Improvement course or a six-hour Mature Driver program). You can complete your training on your schedule and receive your certificate electronically within hours, with your completion data going directly to FLHSMV and your insurer to trigger your discount without paperwork delays. Start your course today and protect your record and wallet.